Gift Card Requests

Should you need to purchase gift cards or cash equivalents (metro cards, etc.), you must request permission to make the purchase via a Gift Card Order Form in iBuy+ under the Requests tab. A screenshot tutorial for the form is available below.

- Requests for Gift Cards or cash equivalents should be completed by the individual from the school or division requesting the cards.

- Once the request is submitted, your Finance Director will receive a notification to approve the purchase of Gift Cards.

- If the Gift Cards will ultimately be charged to a research PTA, the completed Gift Card form will automatically be routed to Procurement for approval.

- If the purchase is greater than $3,500 for the entire funding period under a federal contract or $10,000 for a federal grant, OR $25,000 for non-federal or university funds, please also include a justification for the purchase (via J&A* form for federal contracts or SSM* for all other types of funding) indicating how the Gift Card provider was selected.

- Once the required approval has been obtained, the Gift Cards may be purchased.

- Approval is required prior to purchasing the Gift Cards.

The procurement justification form should be attached within the Gift Card Order Request in Concur. Once the purchase has been made, attach the approved pdf copy of the Gift card Order Form to your Expense Report or Purchase Requisition (for purchases made by PO).

To promote timely submission of P-Card expense reports that include gift cards purchased for human subjects research, you may assign the purchase amount of the gift cards to your R or C fund, and then transfer the charge(s) to the PTA through a DCF once the cards are disbursed.

Payments to Subjects expenses must not be posted to the applicable award until actual payment to the subject has been made. PIs need to estimate the amount of funds required for each 60-day window with the understanding that reconciliation is completed and moved onto the sponsored project within 90 days.

NOTE: Please note that gift cards should not be purchased for or given to employees. Should an employee be given a gift card, that amount needs to be reported to payroll to put on the employee’s W-2.

Keep in mind that the IRS requires 1099 reporting for any recipient receiving $600 or more from all GW sources. If employees or students are potential recipients of the cards, your Financial Director will provide the requestor with the additional reporting requirements for Payroll and/or University Payables. Finance Directors have responsibility for verifying that the requestor provided the information to Payroll or University Payables on a timely basis.

It is the responsibility of the school/division to ensure the proper storage & distribution of the Gift Cards. A log of all Gift Card recipients must be maintained and made available upon request.

_____________________________

*Use the Justification & Approval Form for sponsored research under federal contracts, and use the Supplier Selection Memo for federal grants and non-federal sponsored research.

Gift Card Request Form Instructions

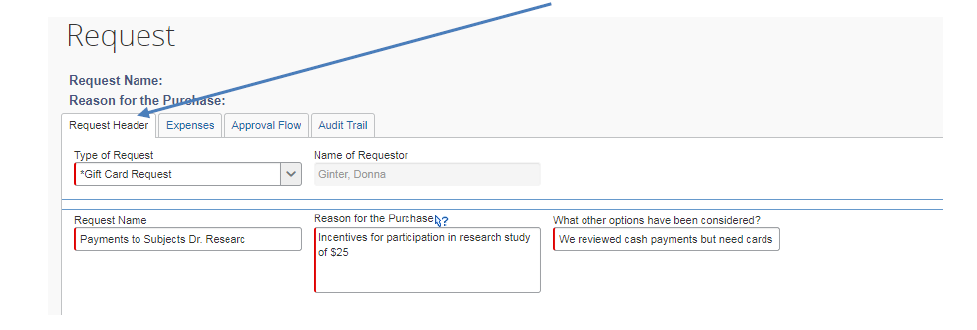

- Under Requests, click “New Request” and then select “Gift Card Request” from the Type of Request Dropdown box. Complete the fields of the Request Header.

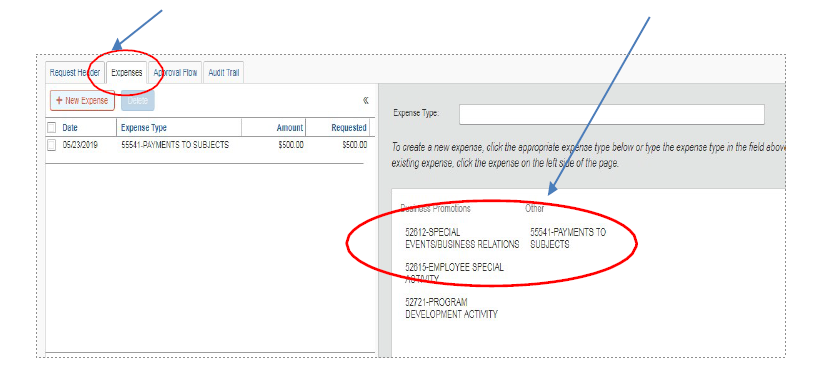

- Click the Expenses Tab and select the type of payment from the provided account codes:

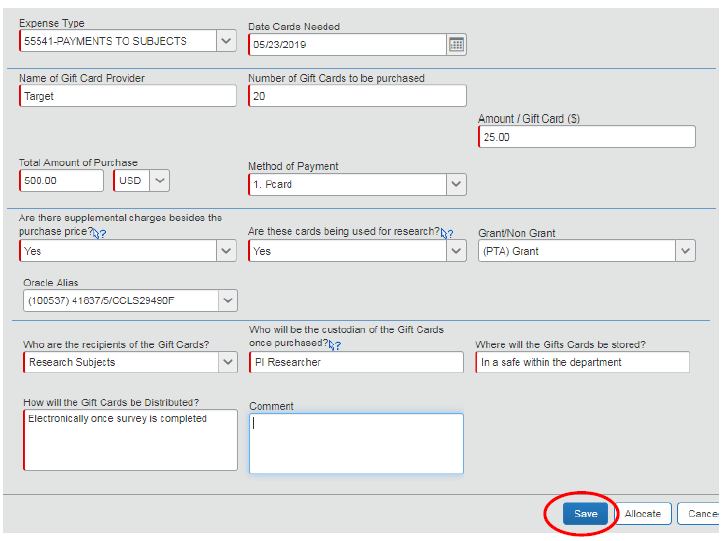

- Answer the questions tied to the purchase of the Gift Cards that will appear once the account type is selected and then click “Save”:

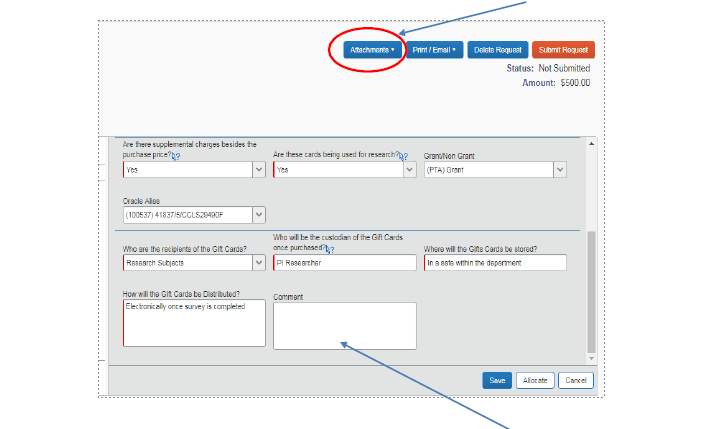

- Should you have a purchase that requires a Justification and Approval form or Supplier Selection Memo for any reason, please attach the form and documentation at the top left of the form:

- If you need to break out the expenses tied to the purchase to separate out any fees (credit card fee and processing fee, etc.) that cannot be billed to the PTA, please add that information within the comments section. As this is not tied to an actual expense yet, there is no need to allocate the funding. Once this section is complete, click on the "Approval Flow" tab.

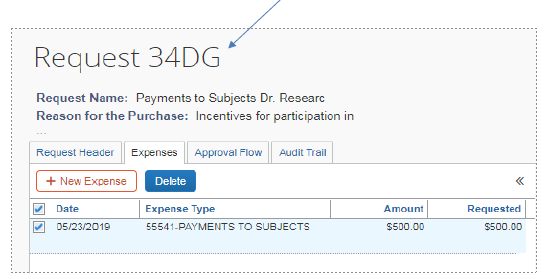

- Note that the system has automatically generated a Request number for these cards. You will be able to search for this request using this ID or by the Request name on the Header Tab.

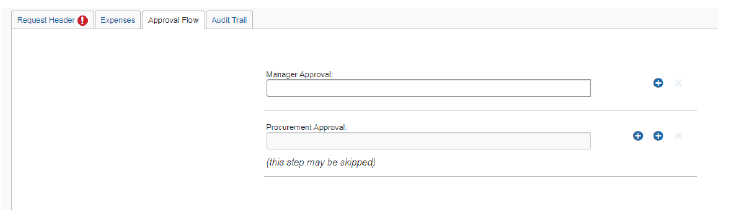

- Under the Approval Flow tab, “just let it flow” - If it normally goes to your Financial Director, it will. No additional individuals should be inserted. Remember this is being purchased on a pcard and/or requisition and they have their own reviews separate from or after purchase (via an expense report).

- Once approved, you can reference the Request number in your expense report, and attach a copy of the request to your transaction along with the receipt.

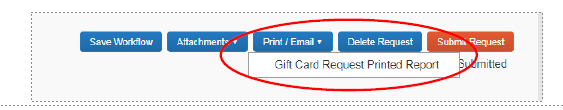

To get a pdf of the Request Form, simply click on Print/Email and select “Gift Card Request Printed Report”.

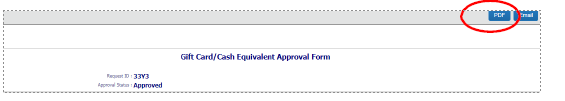

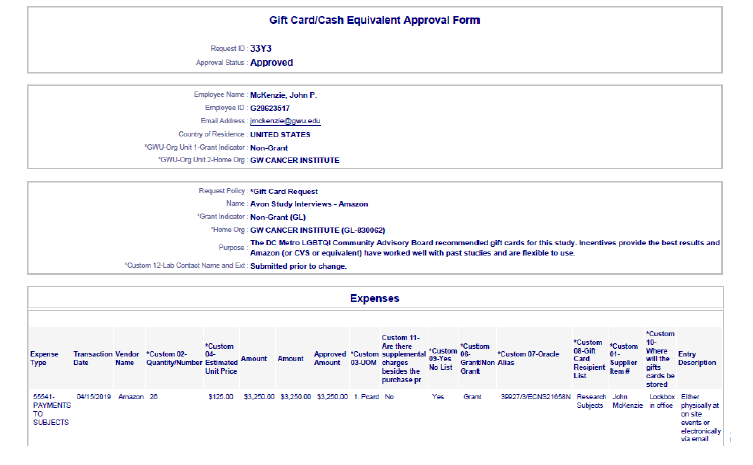

- Your report will look like the screenshot below with all the details. Save it as a pdf for upload into Concur.

- Final document/request looks like this: